Claims are administered by UMR, a division of United Healthcare, and UHC providers serve as in-network providers for participants. The prescription portion of the university's Medical Coverage Plan is administered by MedImpact. Both UHC and MedImpact offer a nationwide network of providers. Co-insurance is the cost sharing percentage of covered health care services split between you and the insurance company once you have met your deductible. If you do not find your insurance carrier listed, please call your insurance carrier.

If you are insured by a plan in which we do not participate, payment in full is expected at each visit. Because there are so many different insurance plans it is not possible for us to know the specific details of every plan. Your insurance policy is an agreement between you and the insurance company. It is best to know what your insurance company will cover before services are received. If you still have questions about your coverage, call your insurance company.

If you do not see your insurance plan listed above you have the option of seeking out-of-network reimbursement. Some insurance plans offer out-of-network benefits which means you can submit statements to your insurance for potential reimbursement. If you have questions about your out-of-network benefits, please contact your insurance company directly.

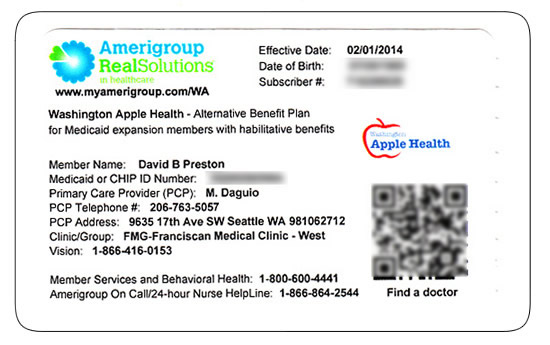

Contact information regarding benefits can be found on your insurance card, usually listed as a phone number for "member services" or "customer support." Some managed care plans require the patient to obtain a referral authorization from their primary care provider prior to receiving services from a specialist. If your plan requires a referral authorization, services will be provided only if the referral authorization is at our office at the time of your visit. You will have the option to sign a waiver accepting financial responsibility for services not covered due to the lack of the referral authorization. If referral authorization is a problem, we can reschedule the appointment.

The university's medical coverage plan promotes wellness. Annual physicals or OB/GYN exams and well-baby visits are covered at 100%. Additionally, employees can participate in a weight loss program called Real Appeal . A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. Cigna ACA/Insurance Marketplace plans are NOT in-network with U of U Health facilities and physicians.

Please check with your benefits department or call the customer service number on the back of your insurance card to find an in-network provider. University of Utah Health contracts with most major health insurance carriers and transplant networks. The Health Savings Plan and Premier Plan offer coverage for out-of-network providers but your out-of-pocket expenses will be higher. Charges in excess of the maximum allowable payments do not count toward meeting the deductible or meeting the limitation on your coinsurance maximum. Non-UA-UMR providers may bill you for amounts in excess of the maximum allowable payment. Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services.

These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims. If you have any one of these plans, U of U Health is in-network for all facilities and physicians. If you have one of these plans, U of U Health is in-network for all facilities and physicians.

The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more. If you see a blank suitcase or a suitcase with PPO inside and the plan is NOT through the ACA/Insurance Marketplace, U of U Health is in-network for all facilities and physicians. The Preferred Tier includes providers, such as Nebraska Medicine and Children's Hospital, that are offering a discount on their services. The lower cost is reflected in the lower deductible, co-insurance, and stop-loss. The In-Network providers are providers that have contracts with UMR to provide services at a specific dollar amount.

Out-of-Network providers are providers who do not have a contract under the university plan. Out-of-Network providers can charge over the negotiated rate that In-Network providers can charge. This means that if a provider charges over what UMR's contractual rate is for a service, the provider can bill the employee and/or dependent for the additional amount. U of U Health is in-network for all facilities and physicians.

If you have Aetna Standard Network, U of U Health is in-network for all facilities and physicians. Many health insurance plans cover nutrition visits with us, often at NO COST to you. Telehealth is also covered by the majority of plans we accept, especially during COVID-19. Since you, as the employee, are electing this coverage on your family, you would be the beneficiary if an accidental death or dismemberment occurred.

In the event that you are dismembered, the policy would pay out to you. If an accident resulted in your death, then the person you have listed as your primary beneficiary under your life insurance with the university would be the beneficiary to this policy. This plan has the highest monthly premiums but you'll pay the least out-of-pocket of all the medical options when you receive care from in-network providers. Participants are eligible for a Healthcare Flexible Spending Account . Luther College is "self-funded" (self-insured) for employee medical and hospital care.

Our Third Party Administrator processes all medical and hospital claims. Luther College pays the actual incurred claim costs and administration fees. Benefits are designed with annual deductibles, co-insurance, and out-of-pocket maximums. Rocky Mountain Health Plans is a network or a group of health care providers and facilities that share a contract. Please ensure that your card has a Rocky Mountain Health Plans logo on it to make sure this is the network that your plan utilizes.

It is a good idea to find providers that are contracted with Rocky Mountain Health Plans in order to access your best level of benefits. A deductible is the amount you will pay prior to the insurance company sharing the cost of medical expenses. The only exception to this would be preventative services.

You pay the full discounted cost of care (at in-network providers) until you meet the deductible, then you pay coinsurance until you reach the out-of-pocket maximum. A PPO is a type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network. Many insurance plans require you to pay a deductible before they will begin to pay. If you are covered by such a plan, you may be required to prepay your deductible. With OptumRX prescription benefits, you have access to great services, ongoing care and support, medical expertise and savings.

OptumRX will help you fill, refill, understand and manage your prescriptions. OptumRX offers convenient home delivery service and in-store pickup for receiving prescription drugs that you take on an ongoing basis. You can manage your prescriptions and track orders 24/7 at the OptumRX website. Ardent gives you and your family access to medical plans that are valuable, easy to use and cost-effective. Choosing the plan that's right for you depends on your family's health care needs and finances.

For both plans, see UMR's website to view your claims and eligibility, order new ID cards, view your flexible spending account information , check on providers and more. You pay additional amounts for certain out-of-network services. The amounts you pay for out-of-network deductibles and out-of-pocket maximums are in addition to what you pay for in-network providers. Your in-network deductibles and maximums do not count toward your out-of-network deductibles and maximums and vise versa. This qualified high-deductible plan has the lowest monthly premiums of all the medical plans but will have the highest out of pocket costs. It includes a Health Savings Account – a tax-advantaged account with contributions made by the University as well as voluntary contributions by the employee.

You and your family members enrolled in the City's health plan can access University of Wisconsin Hospital and Clinics and the charges will be allowed at the in-network benefit level. If you have a dependent attending UW Madison, please let them know they have a local in-network provider. The back of the member ID card includes the member website and phone numbers to connect with customer service, speak with a nurse and discuss behavioral health.

It also includes contact information for providers and pharmacists to submit insurance claims. The covered individual who utilizes this service will have a $40 deductible. At that 50% rate, the insurance will pay a life-time maximum amount of $2,000. The Stop-Loss is how much an employee pays under the co-insurance on covered services before the insurance company picks up covered service expenses at 100%.

MyChart also gives estimates for how much you'll pay out-of-pocket for common health care services using your actual insurance information. If the patient is a child and carries two health insurance plans, then the birthday rule will be applied. The birthday rule states that the parent who's whose birthday falls first will be the parent whose insurance is billed first. As a patient it is important to understand how your insurance plans work together when you are covered by more than one insurance. The process of determining which insurance is the first to be billed is called Coordination of Benefits .

Understanding COB processes and rules helps make sure your claims are paid timely and appropriately. Ardent's medical plans cover preventive care at no cost to you. All three plans also provide coverage for generic and brand name prescription medications through OptumRX. Ardent Network—Ardent offers employees the best costs at facilities and providers that are part of our company and at some designated partner facilities.

While not all specialties and services are available in the Ardent Network, employees will pay the least when they see Ardent Network providers. The back of the member ID card may include phone numbers to connect with customer service, speak with a nurse and find behavioral health support. It also includes contact information for providers and pharmacists to submit claims. If choosing to use insurance benefits, it is the client's responsibility to understand their plan and its deductible. By choosing to use insurance, you will be responsible for this full payment.

If clients have a high deductible, clients may opt to do private pay instead. If we are out-of-network with your insurance, sessions may still be covered. Upon request, we can either send a claim to your insurance on your behalf or provide you with a superbill to submit yourself for possible reimbursement. SBS can not submit superbills without a medical diagnosis. These are the most frequently asked questions, and relevant answers, regarding the important aspects of medical benefits coverage provided to UNO by EyeMed. These are the most frequently asked questions, and relevant answers, regarding the important aspects of medical benefits coverage provided to UNO by Ameritas.

These are the most frequently asked questions, and relevant answers, regarding the important aspects of medical benefits coverage provided to UNO by UMR. All patients must supply us with an up-to-date insurance card. If you fail to provide us with your current insurance card, payment in full for all services is required until you can supply the current insurance card. This list is not all-inclusive and is subject to change.

To check your in-network status with University of Utah Health, contact your insurance company to determine your plan benefits. This list covers insurance plans accepted by University of Utah Health in 2020. It is not all-inclusive, is updated periodically, and may be subject to change. This list is not a guarantee of network participation with any payer. Diagnosis codes are often printed on the Explanation of Benefits statements provided to you by your insurance company following your appointments.

If so, you can upload an EOB from a doctor's visit into our patient portal. When looking at the different coverage options under this plan, there are 50% and 66 2/3% coverage options. These percentages are how much of your income will be paid in the event you become disabled. In addition, there is a 90-day and 180-day waiting period. This is the amount of time you would need to be deemed disabled before the insurance company would begin to pay the percentage of your university salary that was elected. Please visit the Ameritas Dental website at and create an account.

Once you log in and click on the Dental, you are able to review claims, request ID cards, find a Preferred Dental Provider, and get a cost estimate for various procedures. This means that the maximum amount the insurance will pay on a covered person each calendar year, which includes Preventative, Restorative, and Major Services, is $1,500. This provider, due to being out of network, charges $17,000 for the same procedure.

The insurance company will only pay at the contractual rate set with In-Network Providers. We will bill your insurance carrier and assist you in any way we reasonably can to help get your claims paid. If your insurance does not pay your claim within 90 days, you will be billed for the services. Your insurance company may ask you to supply certain information in order to process your claim. It is your responsibility to promptly comply with their request. If the insurance company cannot complete processing of your claim because you have not responded to their request for information, you will be billed for the services.

U of U Health facilities and physicians are in-network with out of state Blue Cross Blue Shield plans as long as the plan uses the BlueCard network. You can usually identify BlueCard eligibility by looking at your insurance ID card and locating a suitcase logo. If you have university health insurance when you retire, you may be eligible to continue your coverage as an eligible retiree. When a retiree and/or their spouse turns 65, university medical coverage automatically becomes secondary to Medicare. The university's medical coverage plan provides coverage for nutritional counseling and weight management. Once you meet the deductible, you and the plan share in the cost of covered medical and prescription drug expenses through coinsurance.

You pay co-payments for doctor and specialist visits, certain other expenses and prescription drugs. Healthy you is published as an educational resource for UMR members and to provide information about tools and resources available within our member online services. Available features and benefits are dependent on the products and features included in the member's plan design.

Here are some examples of UnitedHealthcare member ID cards. Your member ID card may vary depending on your specific health plan and coverage. Feel free to send a picture of your insurance card to and we'll let you know if we identify any issues with coverage. Doing this is NOT a replacement for calling your insurance and asking the questions listed higher up on this page. While we ALWAYS recommend calling your Insurance to check benefits for nutrition counseling.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.